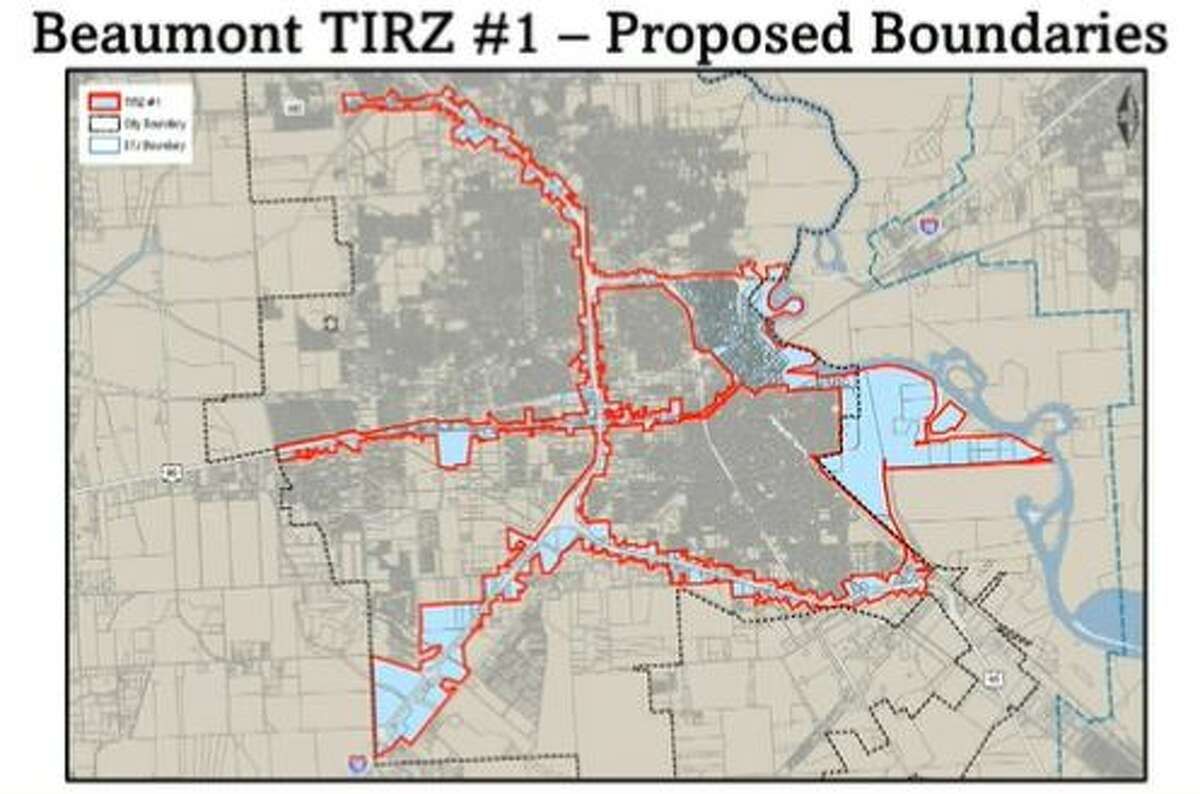

Petty & Associates Consultants, Inc. President Trent Petty presented the proposed Tax Increment Reinvestment Zone to the Beaumont City Council on Nov. 21.

Photo Courtesy of the City of Beaumont

Why this matters: Increased property tax revenues from key corridors in Beaumont could be used to finance the city’s plan to revitalize downtown. But before the plan is put in place, residents have a chance to comment.

Beaumont Enterprise

Courtney Pedersen, Staff writer

Over the next 30 years, the majority of increased property tax revenue coming from downtown Beaumont and other key economic corridors could be earmarked to be reinvested solely in those areas.

- Lake District Restroom Facility -- $685,000

- City Hall Courtyard and Plaza Renovations -- $1.19 million

- New Restroom Facility at the Athletic Complex No. 3 -- $406,000

- 555 Main Street Plaza/Riverfront Park Extension -- $8.77 million

- Civic Center Improvements -- $15 million

- Downtown Revitalization Program; Facade Renovation -- $6 million

- Rehabilitation of Parking Lots and Engelbrecht Drive Rehabilitation -- $1.2 million

- Athletic Complex 4 Baseball Fields Conversion -- $6.5 million

- Carroll and Sycamore Street Roadway Rehabilitation -- $1.7 million

- Park Street Roadway Rehabilitation -- $2.5 million

- Jim Gilligan Roadway Rehabilitation -- $1.5 million

- Highland Avenue Bridge Replacement -- $700,000

- Transmission/Distribution Lines Relocation -- $4.7 million

- Downtown Waterway Feature -- $114 million

Petty said the projects have been identified by the staff, but the list can change and is not in priority order.

"The downtown waterway feature, that is a big project it's going to take a long time, it's going to take a lot money, but we have put that in there so that that's one of the areas you can hopefully leverage private investment to help get some of those improvements paid for," Petty said.

The list also included "Corley Diversion Phase 2" for $15 million which is an example of a Drainage District No. 6 project that could be a part of the TIRZ if the district joins in.

But first, Beaumont residents will get an opportunity to give their feedback on the proposal, called a Tax Increment Reinvestment Zone.

Petty & Associates Consultants, Inc. President Trent Petty presented the proposed Zone to the Beaumont City Council on Nov. 21.

“Tax increment financing is a tool that local governments can use to publicly finance needed structural improvements and enhanced infrastructure within a defined area,” Petty’s presentation stated. “These improvements usually are undertaken to promote the viability of existing businesses and to attract new commercial enterprises to the area.”

Projects that could be funded by the zone is the proposed downtown waterway, improvements to the Civic Center and the extension of Riverfront Park.

Petty said the Zone would create revenues specifically for public improvements without levying new taxes from residents.

For example, say a property was appraised for $1 million on Jan. 1, 2023. If the appraisal value went up 3% on Jan, 1, 2024 to $1,030,000, a certain amount of the taxes collected on the new $30,000 would go into the Zone’s funding.

The city of Beaumont is looking at taking 60% of the taxes collected on the new amount, while leaving the other 40% to go to the general fund as usual.

“Every city does this differently. Some cities are 50-50, some cities are 90-10, it just depends on the city,” Petty said. “We select a 60-40, because this is a large Zone, we want to make sure that we have adequate service dollars available so that as the zone grows and services become more demanded, you’ve got the ability to do that through your general fund.”

Beaumont Director of Communications Lauren Monitz said the amount collected each year will vary based on property tax values and tax rates adopted.

Additionally, Petty said, the county and the drainage district will also have the ability to participate in the Zone, thus bringing in more money.

“However, based on the feasibility study that was conducted, throughout the life of the 30-year TIRZ, the city’s portion of anticipated TIRZ revenue is $77.7 million,” Monitz said. “If other taxing entities, such as the County and Drainage District 6, chose to participate in the TIRZ, the total revenue through the life of the TIRZ is estimated to total approximately $141 million. "

According to Petty’s presentation, there is no risk to the budgets of the city or other involved entities. In fact, in Texas, there are more than 400 such Zones that designate funding to parks and recreation, public facilities, convention centers and water and sewer funds.

“It’s very flexible, and it does give you the ability to give your citizens and your business owners a chance to be able to put dollars into that zone that you can come back and match,” Petty said. “And that’s one of the most important aspects of the entire process is the city will now have designated dollars that you can use to match private sector dollar investment in the zone.”

Should the council approve implementing the Zone, it will have to designate a board. Petty suggested the council members appoint themselves at the outset, because the city wants to get it in place quickly. The county and drainage district will also have representatives on the board.

During Tuesday’s meeting, the council will hear from residents regarding the Zone during a designated public hearing.

The council is then set to vote on adopting an ordinance creating the Zone on Dec. 12.

Petty said if the city goes through with the Zone, the plan is to have it set before the start of 2024.

“We are up against a bit of a deadline, because if we can get this TIRZ created in this calendar year then we collect the entire increment for 2024 into the zone for revenues beginning 2025,” Petty said. “So that’s the reason we’ve structured it the way we have so that you can create the zone and if you want to make changes to it after it’s created you have flexibility to do that without losing the 2024 increment.”